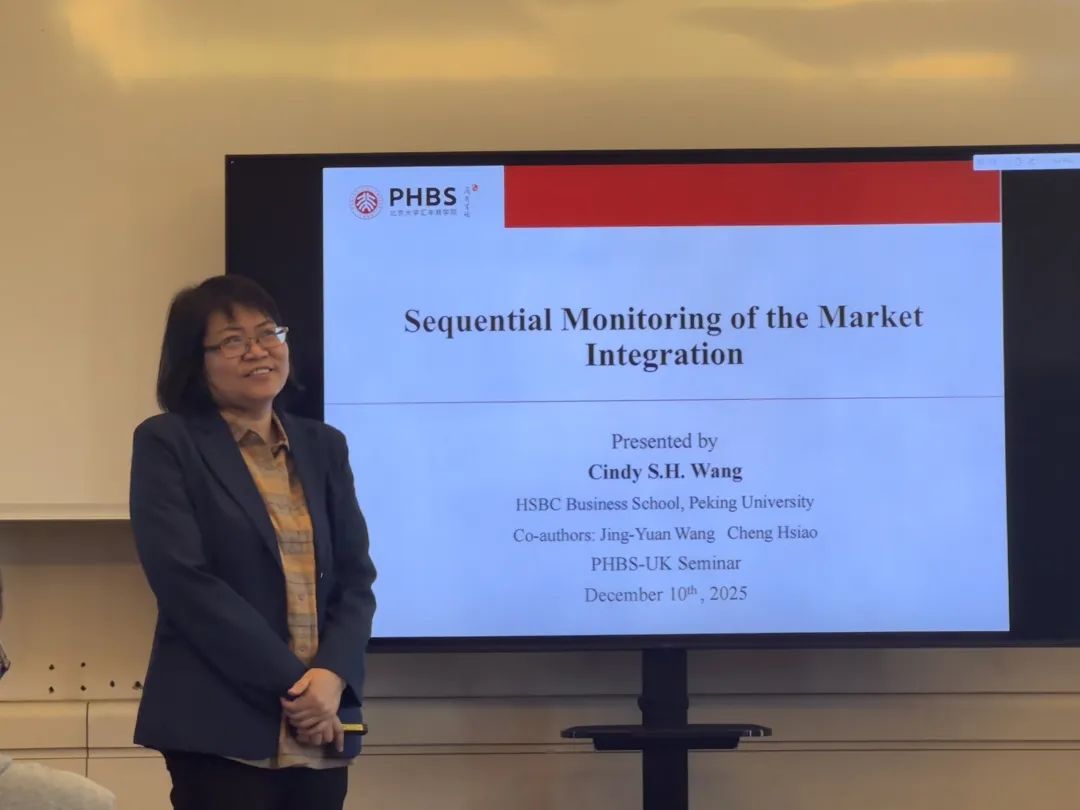

On December 13, 2025, Peking University HSBC Business School UK Campus (PHBS-UK) hosted a compelling session of its Seminar Series, featuring Professor Cindy Wang from Peking University HSBC Business School. The seminar, titled “Sequential Monitoring of Market Integration”, focused on the econometric methodology for detecting time-varying market integration and its implications for financial stability.

Speaker Profile

Dr. Cindy Wang is an Assistant Professor of Economics at PHBS. Prior to joining PHBS, Dr. Wang served as an Associate Research Fellow at the Centre for Operations Research and Econometrics (CORE) at UCLouvain. Additionally, she held the position of Associate Professor in the Quantitative Finance Department at National Tsing Hua University and the Finance Department at National Taiwan University.

Dr. Wang has also served as a visiting scholar at the Bank of Japan, where she is a frequent guest speaker; notably, she was invited to present at the Bank’s internal meeting this year. Her research interests centre on monitoring market patterns and systemic risk in real time and forecasting. Beyond her academic achievements, Dr. Wang is also a practitioner of Chinese medicine.

The seminar began with the professor outlining the core motivation of her paper, situating it within the foundations of econometric methodology. Speaking from the perspective of an econometrician, she emphasized that rigorous empirical analysis must start with careful scrutiny of whether the data satisfy the i.i.d. (independent and identically distributed) condition, which underpins much of classical econometric inference. To illustrate this point, the professor drew an analogy to medical research, comparing econometric modeling to locating the source of an infection. Just as an incorrect diagnosis can undermine treatment, incorrect assumptions about data properties can invalidate econometric results. This analogy underscored the importance of processing data in ways that are consistent with their underlying structure, rather than mechanically applying standard tools. The professor stressed that data should be properly cleaned and ideally exhibit properties such as independence and standard normality. She cautioned that applying conventional measures such as the Pearson correlation coefficient to data that violate the i.i.d. condition can lead to biased estimation and misleading inference, particularly in financial applications where dependence is pervasive.

Building on this foundation, the seminar presented several key insights. First, Dr. Wang noted that financial markets often display long-memory behavior, resulting in strong autocorrelation in time-series data. To address this issue, she highlighted the role of ARMA models in capturing serial dependence and normalizing data, thereby improving the reliability of subsequent analysis. Second, she emphasized that correlation itself carries important economic meaning. Rising correlations across markets may signal spillover effects, increasing the likelihood of asset bubbles and contributing to financial instability.

At the core of the paper is a newly proposed indicator, which the professor demonstrated to be highly effective in predicting financial instability. Compared with existing measures, the indicator exhibits superior efficiency and is particularly well suited for sequential monitoring. The professor emphasized its strong policy relevance, noting that it can be used by central banks and regulatory authorities to forecast risks and monitor the evolving stability of financial markets in real time.

The presentation concluded with a discussion of the paper’s main methodological contributions. First, the research provides a sequential monitoring framework for mixed panels, incorporating a stopping rule defined by a detector and a boundary function. Second, the limiting distribution of the proposed test is free of nuisance parameters, even in the presence of panel heterogeneity. Third, the framework does not require estimation of the exact form of each component in the mixed panel. Finally, the method is straightforward to implement, avoiding the need for bootstrapping procedures or long-run variance estimation.

Overall, the seminar offered a rigorous and policy-relevant contribution to econometric practice, highlighting how careful attention to data properties, dependence structures, and sequential testing can substantially improve the monitoring and prediction of financial instability.

By Jiang Jiawen

Images: Hu Shishi